Healthcare costs are rising for both employers and employees, with the highest jump in 15 years expected in 2026.1

HealthEquity recently surveyed over 600 working Americans participating in employer-sponsored health plans to understand:

- How do rising costs affect different generations in the workforce?

- Which healthcare costs might they skip in the face of rising costs?

- How do Health Savings Accounts (HSAs) affect their healthcare spending?

The findings from our first biannual Healthcare Affordability Pulse illuminate healthcare cost trends facing employees and reveal how benefits teams can help their people save, spend, and invest with confidence. This is a summary of key insights from the research, and you can access the full research report here.

Employees are concerned about the economy and their personal finances.

Nearly 4 out of 5 respondents (79%) said that they are somewhat or very concerned about the overall economy. When asked whether concerns over personal finances had risen in the last six months, the trend held true across high-, middle-, and lower-income groups. Healthcare consumers from all backgrounds are feeling trepidation about the economy.

“I am worried about draining my savings account to pay for everyday expenses. I am also worried about my 401k…I am worried about the stock market and the drop in the U.S. dollar, the economy, the outlook of the U.S. government decisions, the costs of tariffs.”

- Middle-income female from New York, age 70

The survey revealed a generational divide in these concerns. Gen Z (84%) and Boomers (82%)—those just starting their careers and those approaching retirement—reported the highest levels of economic strain. All income levels also shared that they plan to adjust their budgets proactively and reduce healthcare spend due to the economic outlook.

Younger generations are benefits-savvy.

Despite the challenging economic forecast, there is a silver lining. Younger generations, who now make up the majority of the workforce,2 are engaging with their benefits more than ever before.

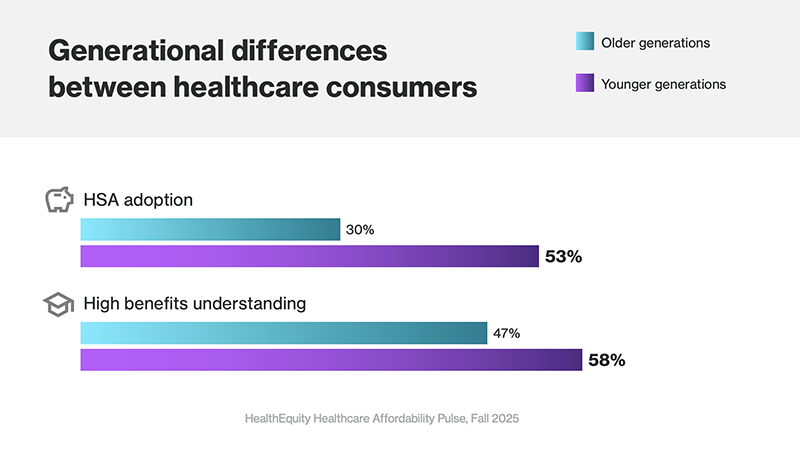

Our research found that Gen Z (56%) and Millennials (50%) have adopted HSAs at significantly higher rates than Gen X (35%) and Boomers (24%).

“Younger workers understand the economic headwinds they’re facing, especially around healthcare costs. They’re benefits-savvy and want to take control of their financial future, but they’re also under real pressure. Employers can be powerful partners by helping them unlock the full value of their benefits, from pre-tax savings to tools that support both day-to-day and long-term financial health.”

- Scott Cutler, HealthEquity President and CEO

Younger generations are also more likely to report understanding their benefits “very well” or “extremely well.” They are educating themselves about options for healthcare savings and planning for future out-of-pocket expenses.

Financial stress is affecting Gen Z and Millennials’ work performance.

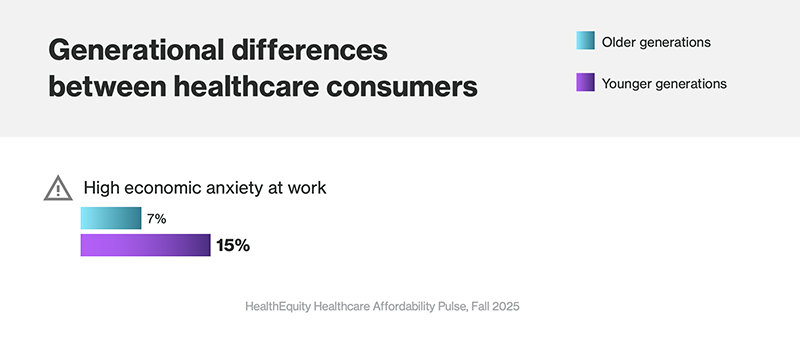

While younger workers are leading the charge in benefits literacy and HSA adoption, they are also bearing the brunt of economic anxiety.

- 84% of Gen Z respondents reported concern about the economy—the highest of any generation

- Younger workers are twice as likely to say that financial stress affects their ability to focus and perform well at work.

Perhaps most concerning is where the younger cohort is choosing to cut costs. Gen Z respondents were the most likely to say they would skip routine preventive care and mental health services to save money.

Employers can tap HSAs to help employees save for healthcare.

How can employers support a workforce that is benefits savvy but economically anxious? HSAs are a powerful tool to build savings and help ease financial uncertainty.

The research revealed that HSA holders are:

- 46% more likely to have a strong grasp of their employee benefits.

- 23% less likely to cut planned surgeries, even if their financial situation worsens.

- 16% more likely to have more than $5,000 in healthcare savings.

Benefits leaders can take an active role in helping Gen Z and Millennial employees save for healthcare with strategies like front-loaded HSA seed contributions, default HSA enrollment, well-designed high-deductible health plans (HDHPs), year-round benefits education opportunities, and dollar-for-dollar matches.

“This research highlights clear opportunities for employers to support benefits-savvy employees who are under real financial pressure. When employers make it easier to save for healthcare and fully use tax-advantaged benefits, they strengthen both their workforce and their bottom line. It’s a win-win.”

- Michael Fiore, HealthEquity Executive Vice President and Chief Commercial Officer

Empower employees with HSAs.

The Healthcare Affordability Pulse highlights a critical opportunity for benefits leaders. Younger employees are eager to engage and ready to save, but they need support to navigate healthcare affordability and prepare for the future.

To learn more about how employers can tackle healthcare affordability and see the full generational breakdown, download the full research paper here.

1Mercer, “Employers prepare for the highest health benefit cost increase in 15 years,” September 2025.

2Department of Labor, Trendlines, August 2024.