Summary: Rising healthcare costs are impacting Gen Z. They are struggling with financial anxiety at work, but they’re also the most likely to use HSA plans. Scott Cutler shares employer opportunities to modernize engagement strategies that build financial resilience and healthcare savings and meet employees where they are – on their phones.

Key recommendations:

- Modernize benefits education

- Rethink plan design and contributions

- Choose partners who innovate

Why is Gen Z struggling with rising healthcare costs?

Not long ago, my Gen Z son started a new job, and with it, he opened a Health Savings Account (HSA) through his employer.

Watching him use it was eye-opening. He wasn’t intimidated by the experience. He was tracking expenses, integrating it into his healthcare decisions, and navigating it entirely through his app. It felt natural to him.

He wasn’t just comfortable; it was intuitive for him. This is how easy it can be when benefits are designed for how people actually live.

But it also raised a harder question: what happens when something goes wrong? What happens in an emergency, an injury, a mental health crisis, or an unexpected medical bill – when the cost hits all at once?

For many in my son’s generation, the answer is concerning. Most don’t have enough money saved to cover their full deductible.1

And that financial anxiety doesn’t stay at home. It shows up at work.

Financial stress is shaping the Gen Z work experience.

Rising healthcare costs are a reality for today’s workforce, but they’re hitting Gen Z and Millennials particularly hard. Together, these generations now make up 54% of the U.S. labor force, and they are navigating financial pressure at a critical moment in their careers.

Emergency medical expenses can escalate quickly:

- Mental health crises: $750 to $2,1002

- Concussion with CT scan: $600 to $6,0003

- Appendicitis: $1,000 to $5,0004

Even one unexpected event can derail financial stability and drain savings.

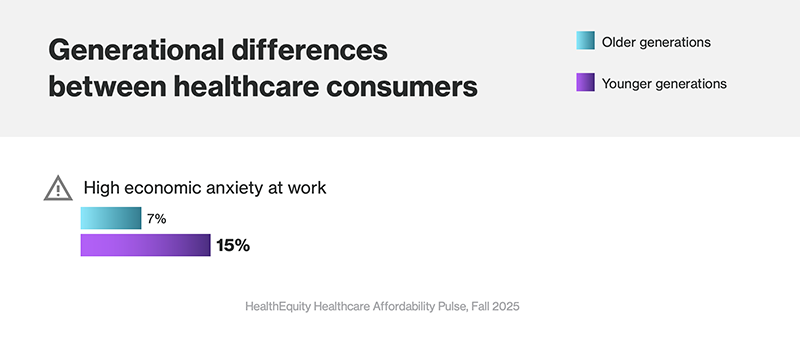

Our latest Healthcare Affordability Pulse confirms what leaders are already seeing firsthand. Eighty-four percent of Gen Z respondents are worried about the economy. More telling, they are more than twice as likely as Gen X and Boomers to report that financial stress affects their ability to focus at work (15 percent vs. 7 percent).

This matters because when people are worried about paying for medical bills or seeking care, it’s harder to do their best work. Financial anxiety follows employees into the workplace, shaping engagement, productivity, and performance. For employers, it’s not just about employee benefits; it’s about business performance.

Younger workers are anxious, but they also lead HSA adoption.

Here’s the paradox: while Gen Z is under the most financial stress, they’re also the most proactive when it comes to managing healthcare costs.

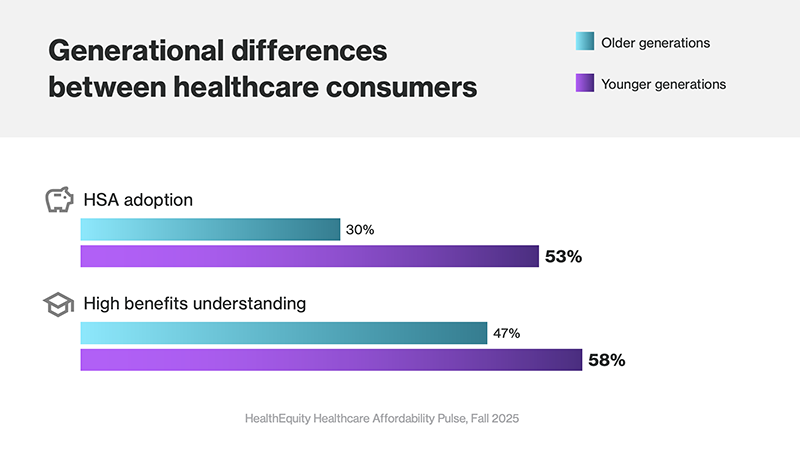

Younger workers are leading adoption of HSAs:

- 56% of Gen Z and 50% of Millennial employees have an HSA.

- Just 35% of Gen X and 24% of Boomers have an HSA.

They also report a better understanding of their benefits. About 53% of Gen Z and 62% of Millennials say they understand their benefits “very well” or “extremely well,” outpacing older generations.

This engagement pays off. HSA holders are 16 percent more likely than non-holders to have over $5,000 saved for healthcare emergencies. When people have the tools to better save, spend, and invest in their health on their own terms, they are better equipped to navigate unexpected healthcare costs.

As one Gen Z respondent told us: “With the amount of money I have saved, I feel like I could bounce back from any situation.” That sense of resilience is powerful, and it’s something employers can help build.

What must employers do to support the next generation?

If employers want to close the gap between high anxiety and high engagement, incremental changes won’t be enough. Supporting Gen Z requires rethinking how benefits are designed, communicated, and delivered.

1. Modernize benefits education.

Traditional benefits seminars don’t resonate with a generation raised on digital and on-demand experiences. Gen Z wants information that’s accessible, personalized, and easy to act on.

That means meeting employees where they are – on their phones, in the moments when decisions matter. Think about using:

These modern communication methods can make benefits education more relevant and effective. When education fits naturally into an employee’s life, understanding follows.

2. Rethink plan design and contributions.

Offering an HSA is a great first step, but it’s not enough on its own.

To drive adoption and meaningful savings, we need to look at how plans are structured. Default enrollment and contributions into HSA-qualified high-deductible health plans (HDHPs) can help young employees start building a safety net from day one, just as it did for 401(k) participation.

Employer contributions matter, too. A seed contribution at the start of the year can be a powerful equalizer — helping alleviate immediate financial anxiety and giving employees the confidence to choose plans that support long-term savings.

3. Choose partners who innovate.

Your benefits partners should be as digitally fluent as your workforce. Look for platforms that offer:

The right partner will offer enrollment and engagement experiences that feel intuitive to a digital native. If your benefits platform feels like it was built in 2005, you are already losing the engagement battle. Your partner should enable employees to make smart decisions with confidence.

Empower the next generation.

Gen Z may be worried about their healthcare finances, but they are also ready to act. They are embracing HSAs faster than any generation before them, and they are engaging when the experience is built for them.

As leaders, we have the responsibility to nurture that instinct. When we make benefits easier to understand and easier to use, we don’t just reduce financial anxiety. We build confidence, resilience, and trust.

And when employees feel confident navigating their healthcare finances, they show up differently at work.

That’s better for people – and better for business.

1HealthEquity Healthcare Affordability Pulse, 2025.

2Cost of treat and release emergency department visits in the United States, 2024.

3Bettercare.com cost estimator

4Behind the Bills: A Breakdown of Appendicitis Survey Costs with Insurance Coverage, 2025.

HealthEquity does not provide legal, tax, or financial advice.