Summary: Healthcare affordability for employers in 2026 requires a three-pronged approach:

- Active management of high-cost pharmacy drivers like GLP-1s

- Optimized Health Savings Account (HSA) plan designs

- Integration of Artificial Intelligence (AI) to streamline benefits education

If the price of apples had followed the same inflation trajectory as healthcare since 1969, a single pound of apples would cost $14.57 in 2025.1 That is roughly $5 to $7 for one apple.

While this analogy is startling, it illustrates the very real pressure facing benefits leaders today. Employers are operating in a landscape defined by economic fluctuations and uncertainty. Experts predict a 6.5% rise in total benefit costs per employee in 2026 – the steepest rise in 15 years. Additionally, 59% of employers plan to cut costs this year.2

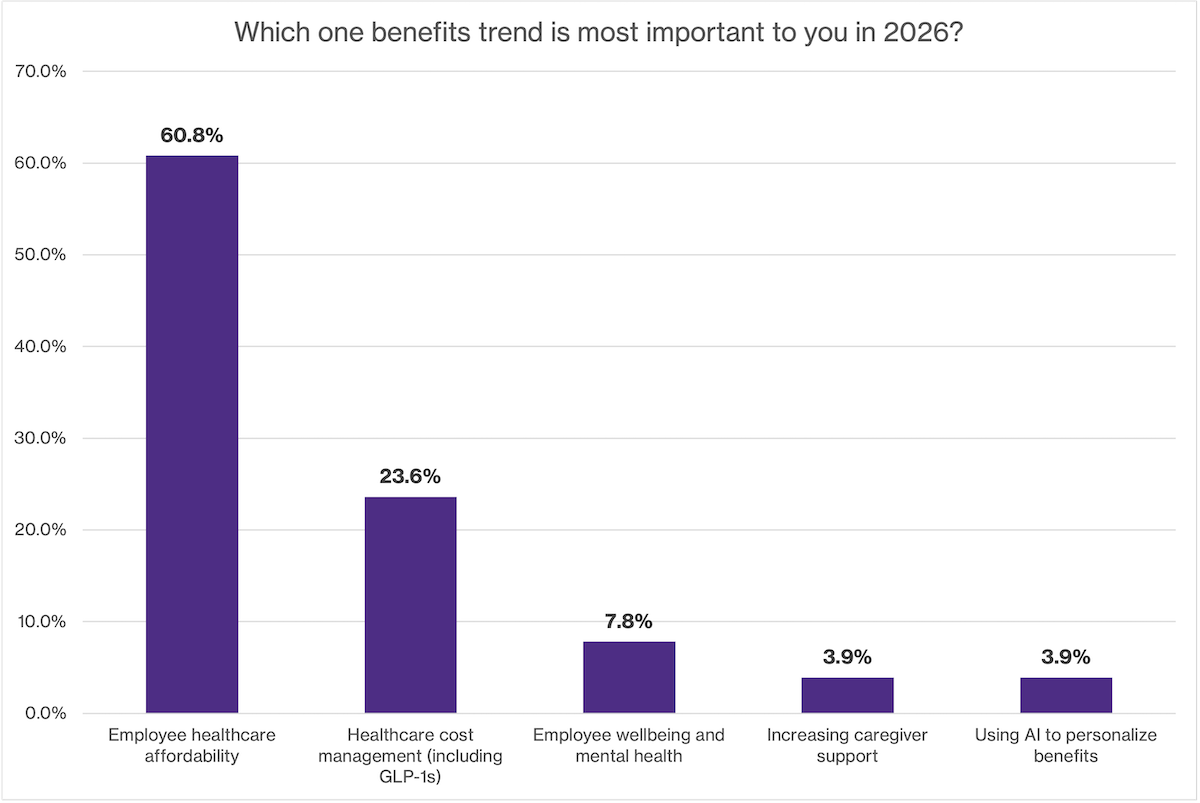

However, employers are unwilling to shift costs to employees. In a recent HealthEquity webinar, attendees told us employee healthcare affordability was the most important trend for 2026 (60.8%), clearly signaling that it’s a priority over cost management (23.5%).3

The challenge is clear: How do you balance the budget without compromising the care your employees need? Here are three strategic ways to address healthcare affordability in 2026.

1. How can employers manage rising GLP-1 costs?

Employers can mitigate pharmacy costs by implementing clinical programs that pair GLP-1 coverage with lifestyle support and by auditing Pharmacy Benefit Manager (PBM) contracts for greater transparency.

Pharmacy costs are an enormous driver of rising healthcare costs, with specialty drugs like GLP-1s leading the charge. In a recent webinar panel discussion with HealthEquity, Ned Godwin, VP of Benefits at TIAA, shared:

“Our pharmacy trend [for 2025] was actually 31.4%, which is just astronomical. It’s GLP-1s, and we do cover them for weight loss. We just have so many people beginning that treatment now that we actually had a 104% increase in GLP-1 utilization.”

For many employers, GLP-1s represent a dilemma. They offer significant health benefits for employees struggling with obesity and diabetes, but they come with a high price tag. According to a recent Mercer report, only 44% of employers are currently covering them for weight loss.4

Here are some strategies benefits leaders are using to manage GLP-1 costs:

- Implement clinical programs: Employers, including Ned Godwin of TIAA, are implementing weight management programs as part of their GLP-1 strategy. Employees can enroll to meet with a dietitian, get personalized support, and monitor their prescription as part of their strategy. This ensures that the medication is part of a holistic health strategy rather than a standalone cost.

- Review Pharmacy Benefit Manager (PBM) partnerships: Now is the time to audit PBM contracts. Are you getting the transparency you need? Do you have access to the data for better decision-making? Some employers are exploring alternative PBMs or point solutions that specialize in high-cost drug management to ensure they are not overpaying for their prescriptions.

- Encourage HSA use for GLP-1 costs: Let employees know that they can pay for these drugs using their HSA dollars. HealthEquity recently partnered with Agile Telehealth5 to offer our HSA members access to weight management solutions that are payable using their pre-tax HSA savings. Members can pay for eligible care with tax-advantaged dollars through their HealthEquity account, helping their healthcare spending go further.

2. How does health plan design improve healthcare affordability?

Improving healthcare affordability requires revisiting high-deductible health plans (HDHPs) to ensure HSA seed contributions are sufficient to bridge the gap between the deductible and the employee’s ability to save.

How often are you evaluating the design of your high-deductible health plan (HDHP)? Or looking at your contribution strategy for your HSA program?

According to the Kaiser Family Foundation, the average HDHP + HSA plan deductible is $3,650, while the average employer HSA contribution is just $960.6 This makes it difficult for employees and their families to choose the HSA option – they’ll have to come up with $1,590 every year to cover the difference, and that’s not easy with today’s economic headwinds.

Here’s what Michon Caton, Reward Partner at Roche / Genentech shared with us in a recent webinar:

“We offer a pretty nice [HSA contribution] seed to our employees. Oftentimes, that’s what really helps our employees understand the benefits of even participating in an HSA. It helps them understand the seed that we’re giving you can be applied to your deductible, which reduces the employee’s dollar amount out of their pocket.”

Seed contributions reduce the anxiety of starting with a high deductible on the first day of the plan year, even in combination with a match contribution.

Benefits leaders may also consider:

- Default enrollment in the HDHP + HSA plan for new hires.

- Default payroll contributions equivalent to the premium savings compared to the PPO plan.

- Benefits education efforts to bust common HDHP and HSA myths.7

3. How can AI personalize the benefits experience?

AI tools can help guide employees toward cost-effective care options and automate benefits education, ensuring they understand coverage and avoid unnecessary expenses like ER visits for non-emergencies.

The third lever for tackling affordability is efficiency. This is where AI transitions from a buzzword to a practical tool for benefits teams.

Navigating the healthcare system is notoriously difficult. When employees do not understand how to access care, what’s covered, or how to make financially sound decisions, they’re likely to use their benefits inefficiently. For example, they may visit the ER when an urgent care visit would have suited their needs or skip preventive care thinking it would result in a bill. Forward-thinking benefits leaders are using AI to help employees access the right info, understand their benefits, and make informed decisions.

“We actually just released a new HR chatbot. It has actually done a scrape of our benefits portal. You can ask it almost any benefits question. Like any AI tool, it’s still learning, but the answers are very good. It gives great information on plan design, recommendations, on how to get in-network care, and things of that nature.”

-Ned Godwin, VP of Benefits at TIAA

By automating routine inquiries and benefits education, your HR team can reclaim hours previously spent on administrative tasks. This allows you to focus on high-value strategic initiatives—like analyzing plan design effectiveness or negotiating better vendor rates—that directly impact your bottom line.

Turning uncertainty into opportunity

The landscape of 2026 will undoubtedly bring challenges. Whether it’s pharmacy benefit costs, plan design, or the rise of AI, benefits teams are tackling some of the fundamental trends that are impacting employee’s lives. But one thing is clear: employers care about supporting employees through rising costs.

Emily Roberts, VP, Director of Benefits at Fidelity National Financial, shared her perspective during our recent webinar:

“I want everyone to be happy, but when we have to make major changes, the person I think about is that lower-income earner, and what impact that is going to have on them.”

This is the heart of the challenge for benefits leaders. They are at the intersection of affordability for their employees AND for their organization. By actively managing high-cost drivers like GLP-1s, investing in employee’s healthcare savings, and leveraging technology to guide better decision-making, you can build a benefits program that may help address healthcare affordability for your people.

Frequently Asked Questions

Q: Why is healthcare affordability a top priority for 2026?

A: Healthcare affordability is a priority because rising inflation and benefit costs (projected to rise 6.5%) are squeezing both employer budgets and employee wallets. Employers are prioritizing affordability over simple cost-cutting to ensure their workforce remains healthy and financially stable.

Q: What is an HSA seed contribution?

A: An HSA seed contribution is an upfront deposit made by an employer into an employee’s HSA at the start of the plan year. This helps offset the immediate burden of a high deductible, making the plan more affordable and attractive to employees.

Q: Does AI play a role in benefits education?

A: Yes, AI can help meet employees where they are – many are already using AI tools for everyday searching. AI can help you educate employees on how to use their benefits efficiently, such as choosing in-network providers or utilizing urgent care instead of the ER. The time savings could be used to help HR teams to focus on strategic cost-saving initiatives like vendor negotiations.

2Disclaimer: Results may vary based on employer size, demographics, and plan design

3Mercer, “Employers prepare for the highest health benefit cost increase in 15 years,” September 2025.

4Mercer, Survey on health & benefit strategies for 2026.

5Agile Telehealth and HealthEquity are separate companies and are not responsible for each other’s policies or services. When you engage with Agile Telehealth through a HealthEquity link, we may earn a referral commission.

6KFF 2024 Employer Health Benefits Survey-Sections 7 and 8 HSA Plan composite Deductible and Employer Contribution @ 57% single-enrolled and 43% family-enrolled, numbers shown rounded to nearest 10.

7Disclaimer: Actual savings and adoption rates may vary.

HealthEquity does not provide legal tax or medical advice.